|

Now that you have a full month of Counting done in categories, let’s look at money afresh & see if we can move it around so you live within your means and nurture your priorities.

Which is higher? Income or Outgo? (I don’t need to tell you which it should be, but whichever it is, defer judgement or assumptions for now, and read on.) 4. Add up each individual category to get its sub-total, and write these in your Counting Book where you can see them all at once, in one column or row.

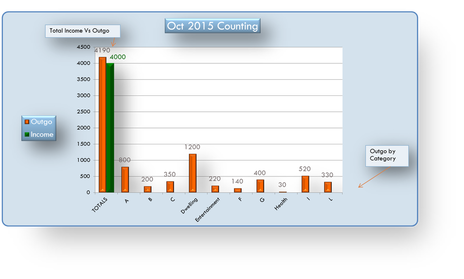

5. Look at these categories & their totals. Do the figures seem proportionate to your priorities? That is, higher for high priorities, minimal for the rest? The funny part about this step is that you won’t even need a calculator to tell you. This is one of those times when gut feeling works fine, up to a point. You’ll resent some expenses just looking at them! Others can make you feel wistful, smug or even chirpy! However, these feelings may change after you do the next bit, so don’t take them too seriously. Humble pie is free, but it tastes like ... well, here’s the next bit: 6. Draw these on a bar graph, like this: I've put a useable copy of this Counting Graph on the DIY page for you to play with. Make up your own if you’re handy with spreadsheets, or just draw it in your Counting Book. Then all you have to do is this: A. To live within your means, simply squish the tall orange bar down so it’s lower than the green bar.

By the same token, I should probably have called Income something more proactive – Earnings might do, but the focus here is on watching the money flow in and out & seeing where it’s imbalanced (if so). B. The other way to live within your means, of course, is to whoosh the green bar up above the orange one! Even then, you’ll benefit from reducing unhelpful outgo first, so you’ll have even more money to play with once you find a new or better source of income.

Well done on getting through these long posts.

Hope you find it easier to look at money now!

0 Comments

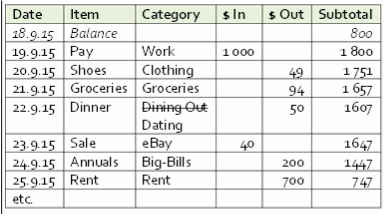

If you’ve been Counting since Looking at Money (Part 1), you will have now recorded a month of spending – and earning – to look at. During this month you will have engaged in most categories of everyday spending. You’ll be able to see where your money goes and turn the exercise into a planning tool (Part 3) instead of purely recording. Do the following steps to prepare you for Part 3 (then continue Counting for a few days to make sure it all looks right).

Make sure you are including all this month’s income: tips, commissions, side-business drawings, the lot. If you had an unexpected windfall, I’ll have to let you work out how to apply that to one month, depending on the amount and cause of the windfall. If in doubt: Underestimate Income, Overestimate Outgo.

If there are any surprises later, you'll want them to be pleasant! Your body should last you a long time if you maintain it properly. Exercising it in various ways is one action you can do towards that. Today, diarise a schedule of your choosing to prompt you to physically exercise. (I’ll talk about mental exercise in another post, but will mention now that walking is my favourite way to do both at once. I can’t recommend it highly enough.) Physical Exercise If you have an exercise routine, do something on it today, & diarise the next sessions for this month.

Women readers, pay special attention to the above guideline's warning on ‘Double leg raises’. The alternative looks interesting. A note about links:

Links merely suggest information that appears reliable. Think for yourself when following anyone’s advice. E-safety Tip: You can right-click a link and copy the address to paste it into a browser address bar, as a safer alternative to direct clicking. This is also useful if the link no longer works – you can trace back through the pasted address to the site’s home page. I'm just staggering in to do this post. Rather shaken after a near-computer-crash. And the danger’s not over yet. Ka-thud, ka-thud, ka-thud, goes my little heart – in all the wrong ways. Thankfully, all my backups are up to date, so this seems a good time to mention gizmo maintenance. You’ll see that some steps can be done while you’re getting on with your Weekly Wrap-up or Cleaning. Set a time frame to do the others, or they will really burn up hours:

Again, call in an expert if you're unsure of how to do steps safely.

Run through them every month to keep e-clutter from building up. If you’re looking for something to do to close the weekend off, why not plan out the next 3 months? The busy social season is coming up! Even if Christmas and New Year are not a big feature in your life, it’s hard to avoid the changes this quarter brings – in workplaces, social & business circles, & in shopping patterns. Navigate these without losing pace on your own plans, by diarising appointments with yourself to attend to projects and ongoing tasks. Then keep those appointments as though the person waiting for you is the most important, most demanding person in your circle! You don't want to kiss them off ;-) My Everies Learning Curve Bookmarks are a handy way to incorporate such planning into your regular diary entries. (The product link above has been updated on 31.7.17 to replace the Financial Year Diary mentioned in the original post.) Especially, keep up the Counting!

I’m keen to give you Part 2 about that, but there’s a little way to go yet. Just a quick one -- my 2nd-quarter Everies Perpetual Reminder Diary is now available in the store. Here's a sample page: Hope you like it!

Whether you use this one or a different type, ensure you diarise your plans ahead of those imposed on you by others or life in general. If you don't put your plans first, and give yourself the orders to carry them out, who will?? Make next quarter work on your side :-) Cheers, Heidi |

In using this blog, please Note:

|

RSS Feed

RSS Feed