|

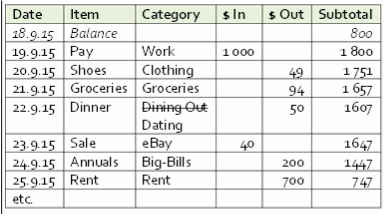

If you’ve been Counting since Looking at Money (Part 1), you will have now recorded a month of spending – and earning – to look at. During this month you will have engaged in most categories of everyday spending. You’ll be able to see where your money goes and turn the exercise into a planning tool (Part 3) instead of purely recording. Do the following steps to prepare you for Part 3 (then continue Counting for a few days to make sure it all looks right).

Make sure you are including all this month’s income: tips, commissions, side-business drawings, the lot. If you had an unexpected windfall, I’ll have to let you work out how to apply that to one month, depending on the amount and cause of the windfall. If in doubt: Underestimate Income, Overestimate Outgo.

If there are any surprises later, you'll want them to be pleasant!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

In using this blog, please Note:

|

RSS Feed

RSS Feed