|

Now that you have a full month of Counting done in categories, let’s look at money afresh & see if we can move it around so you live within your means and nurture your priorities.

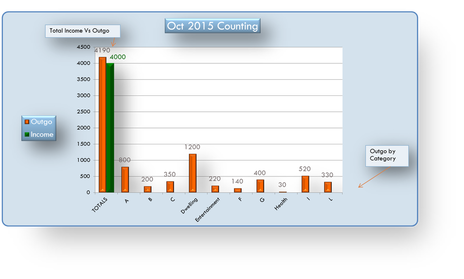

Which is higher? Income or Outgo? (I don’t need to tell you which it should be, but whichever it is, defer judgement or assumptions for now, and read on.) 4. Add up each individual category to get its sub-total, and write these in your Counting Book where you can see them all at once, in one column or row.

5. Look at these categories & their totals. Do the figures seem proportionate to your priorities? That is, higher for high priorities, minimal for the rest? The funny part about this step is that you won’t even need a calculator to tell you. This is one of those times when gut feeling works fine, up to a point. You’ll resent some expenses just looking at them! Others can make you feel wistful, smug or even chirpy! However, these feelings may change after you do the next bit, so don’t take them too seriously. Humble pie is free, but it tastes like ... well, here’s the next bit: 6. Draw these on a bar graph, like this: I've put a useable copy of this Counting Graph on the DIY page for you to play with. Make up your own if you’re handy with spreadsheets, or just draw it in your Counting Book. Then all you have to do is this: A. To live within your means, simply squish the tall orange bar down so it’s lower than the green bar.

By the same token, I should probably have called Income something more proactive – Earnings might do, but the focus here is on watching the money flow in and out & seeing where it’s imbalanced (if so). B. The other way to live within your means, of course, is to whoosh the green bar up above the orange one! Even then, you’ll benefit from reducing unhelpful outgo first, so you’ll have even more money to play with once you find a new or better source of income.

Well done on getting through these long posts.

Hope you find it easier to look at money now!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

In using this blog, please Note:

|

RSS Feed

RSS Feed